BLOCKCHAIN – is a decentralised, distributed ledger system offering complete transparency, used for numerous tech advances, including intellectual property rights (patents, designs, copyright and trade marks), encompassing digital identity, asset provenance and royalty distribution.

IP RIGHTS

Whilst patent protection provides a 20-year monopoly and corporate tax (patent box) relief, to register a patent, you must evidence the novel use of the technology – the inventive step, this is the key element for the registrability of a patent, rather than the utilisation of blockchain. At present, there are 5,835 patents (filed/registered/dead) including the term “blockchain” registered at the European patent office.

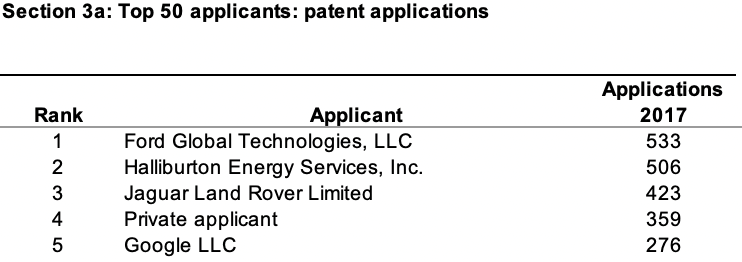

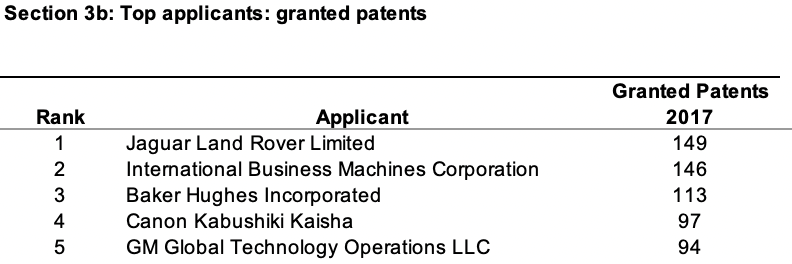

The success rates speak for themselves, in 2017 the UKIPO recorded the following patents (not exclusively related to blockchain):

Whilst the above figures are only a snippet of the actual patents filed, it shows the disparity between patents filed and patents granted. Whilst the blockchain source code may not be patentable, it may be automatically protected by copyright (please note, certain circumstances must be satisfied).

Employer or consultant? – Whether you seek to protect your prospective patent or copyright, it is important to protect your intellectual property. Therefore, it is key to ascertain who is the creator of the IP, are they an employee or consultant? As an employer you will have automatic ownership of IP created by your employees (in certain circumstances), however, any IP created by a consultant, even if expressly commissioned will automatically belong to the consultant, unless you have an agreement in place where the IP is assigned to your company. If an agreement is not already in place, then an IP assignment should be implemented.

Please note, if your employee creates a patent, whilst you may own the patent, your employee may be able to claim compensation if the patent is of outstanding benefit to your company.

Research and Development – Patent Box – provides an optional 10% corporation tax rate for companies benefiting from patented inventions. The 10% corporation tax rate relates to profits from licensing your IP rights, selling the patent or your products using the patent (your company must have created or developed the patent granted by the UKIPO or EPO or certain EEA territories).

Author: Christine Zembrzuski